Enterprise Fraud Management System

for Banking, Fintech & Payments

Protect every transaction, trust every customer

We Got Your Back

Fully Managed Service

Because we care about your growth and safety, we are with you every step of the way providing you with a dedicated tech & fraud team.

Tailored Fraud Prevention

With our 20+ years of industry knowledge, we know how fraudsters operate and how to stop them.

Frictionless User Experience

Protect your users from fraud without compromising their experience with extra steps of authentication.

Fast and Easy Integration

No need for lengthy complex processes or wait to build profiles – integrate in a matter of days.

Cost Reduction

Streamline the entire process and get rid of costly steps. Save time and money on resources with our fast implementation process.

Detection from Day 1

From the moment your customer opens the app we can start detecting potential fraud

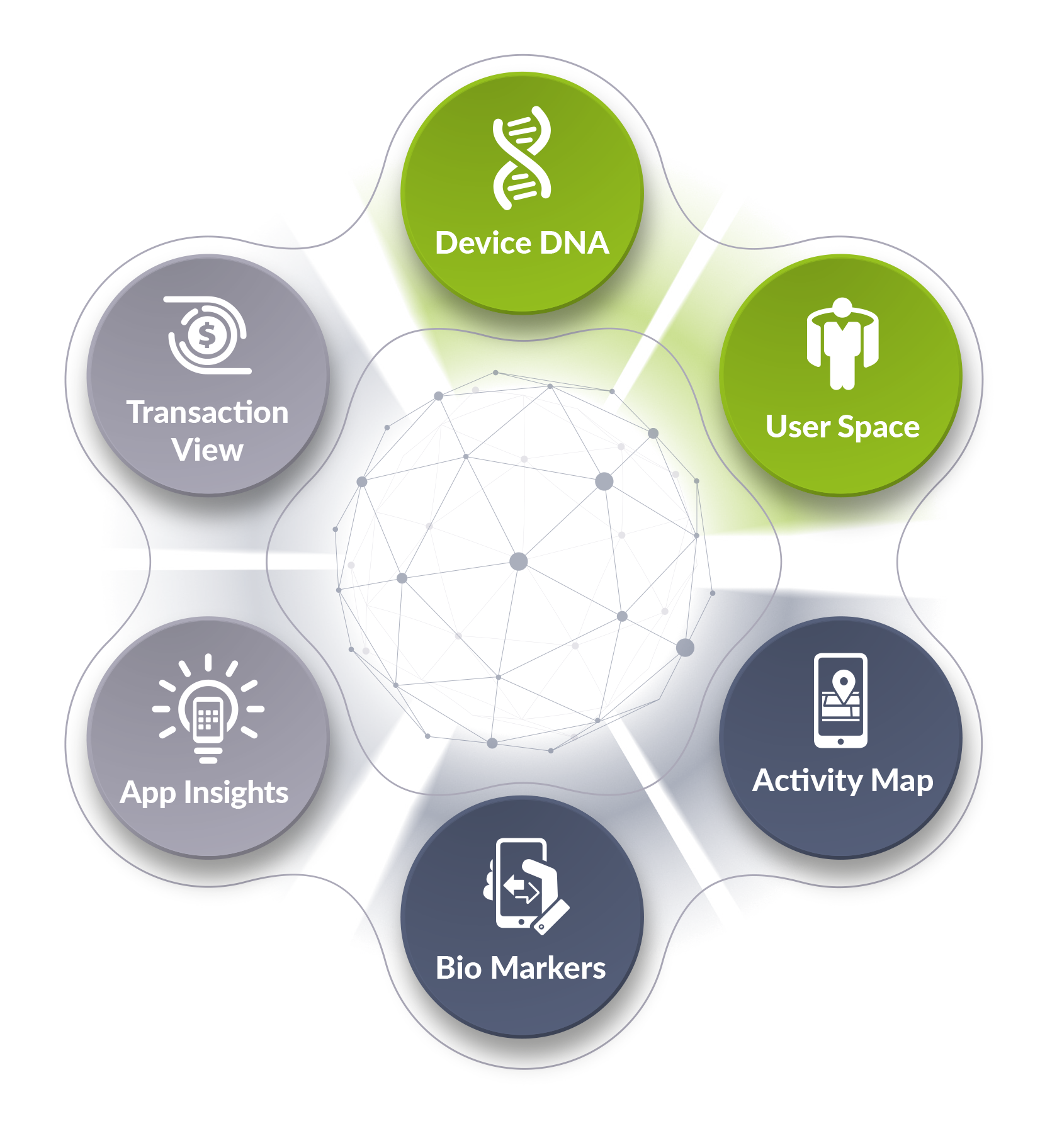

How We Do It

Paygilant’s solution comprises 6 Intelligence Sets which are designed to distinguish between legitimate and fradulent activities. Each intelligence set observes and analyzes various attributes throughout the user’s journey, prior to performing the transaction.

What Our Customers Say

Updated Resources

NEWS

BLOG

Recent Collateral

New Datasheet - Paygilant for Challenger Banks

Paygilant is the first vendor to pioneer a true frictionless, layered mobile fraud prevention solution, designed for challenger banks . Learn how Paygilant can help challenger banks prevent fraud and ensure frictionless authentication, while boosting profits.

New White Paper - Beyond Behavioral Biometrics

When it comes to fraud prevention and authentication, behavioral biometrics provides is a single, static form of intelligence attainment. So why not maximize your intelligence sets?

When it comes to fraud prevention and authentication, behavioral biometrics provides is a single, static form of intelligence attainment. So why not maximize your intelligence sets?