Infographics

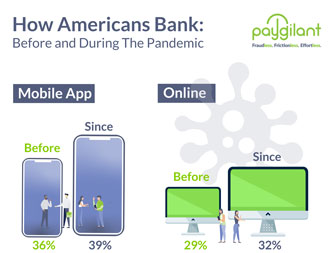

How Americans Bank: Before and During The Pandemic

Americans have embraced the digital banking revolution. The infographic demonstrates to what degree US consumers have adopted digital banking during and post pandemic.

What 2020 Taught Us About Digital Banking?

New normal, old normal and not normal. What 2020 taught us about digital banking?

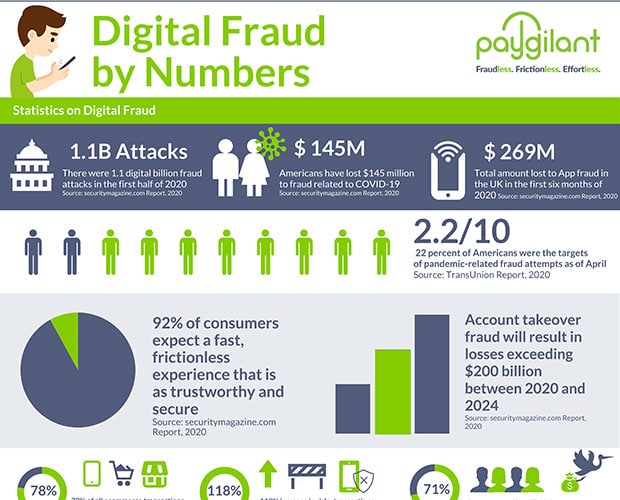

Digital Fraud by Numbers

Digital Fraud is on the rise everywhere. And the pandemic is not slowing it down – in fact during the pandemic digital fraud has skyrocketed throughout the world. Our recent infographic sheds light on the problem via statistics and numbers.

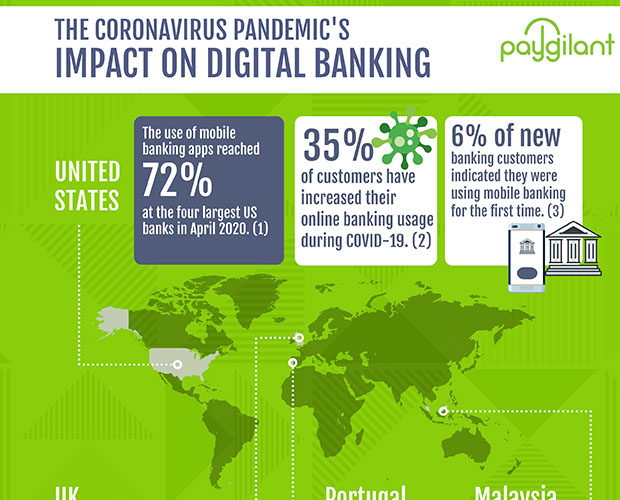

The Coronavirus Pandemic’s Impact On Digital Banking

COVID-19 has changed the global digital banking in a profound way. Increased fraud complexity and changing consumer behavior will alter the financial ecosystem forever.

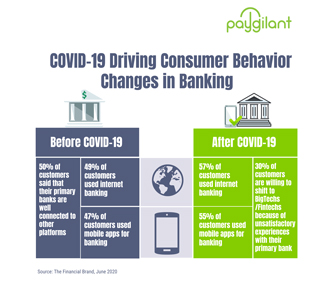

COVID-19 Changing Consumer Behavior in Banking

The COVID-19 pandemic moved more consumers to digital channels than any single event in our lifetime. Digital Banking is here to stay. Paygilant prevents digital bank fraud and ensures a frictionless customer experience.

The Changing Trends in Latin American Digital payments

Digital payments in Latin America have undergone a massive transformation, triggered by the influx penetration of smartphones, the arrival of fintech companies offering various wallet apps, and rise of digital-only banking services. are flocking to e-commerce and contactless payments.

The 6 Ways COVID-19 Will Impact Payments

COVID19 is wreaking havoc on the world economy, impacting multiple industries. One sector that has been adversely hit is the payments industry. The Coronavirus has drastically changed payment habits, as consumers shift to digital channels to reduce the risk of infection from handling cash.

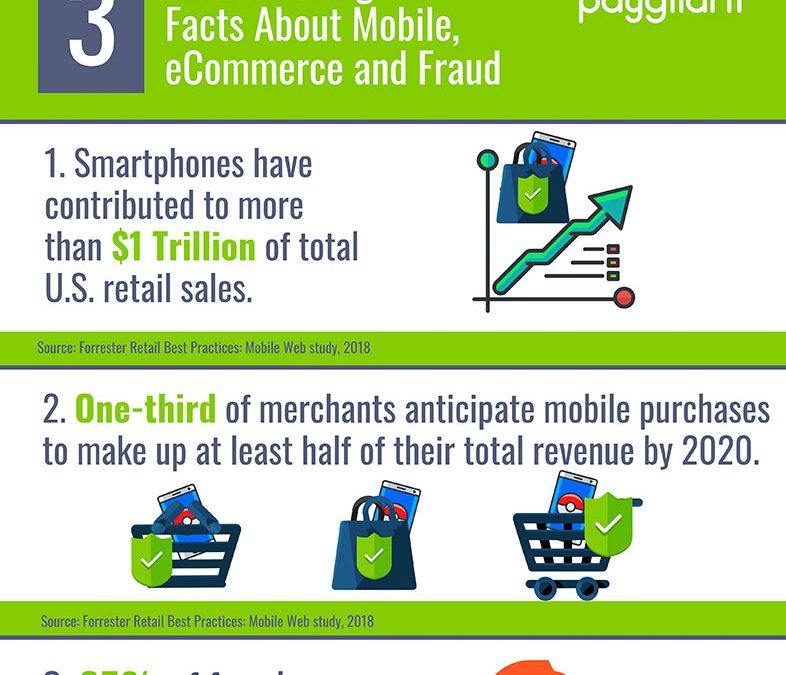

Mobile eCommerce Fraud

Mobile fraud is exploding: Three mind-bending facts about mobile, eCommerce and fraud.

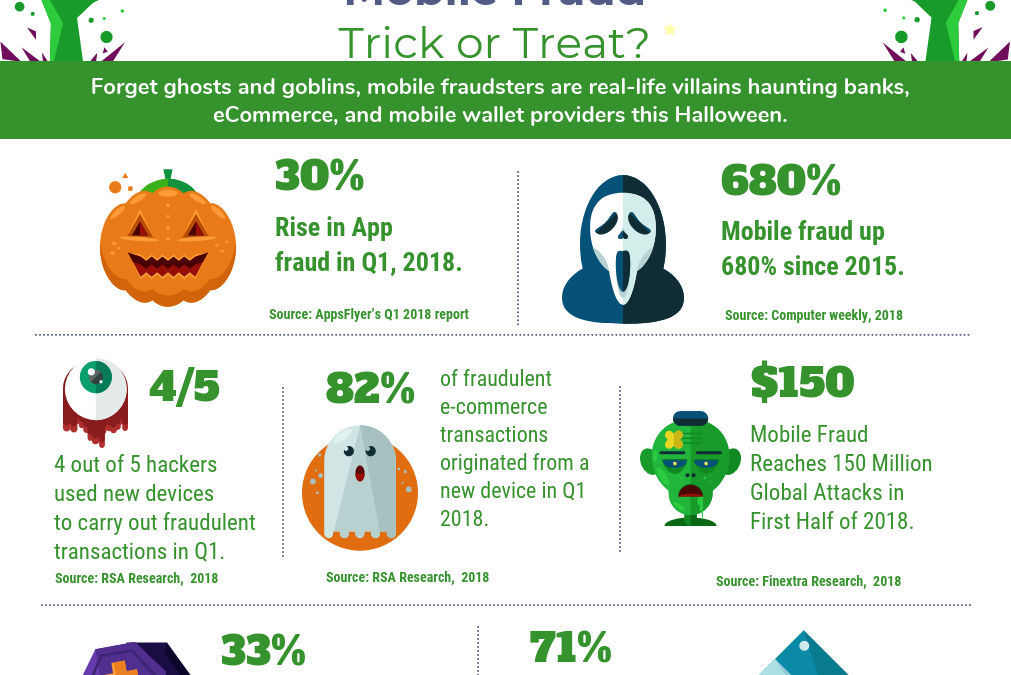

Mobile Payment – Trick and Treat?

Mobile payments horror stories in time for Halowwen. orget ghosts and goblins, mobile fraudsters are real-life villains haunting banks, ecommerce and mobile proivders

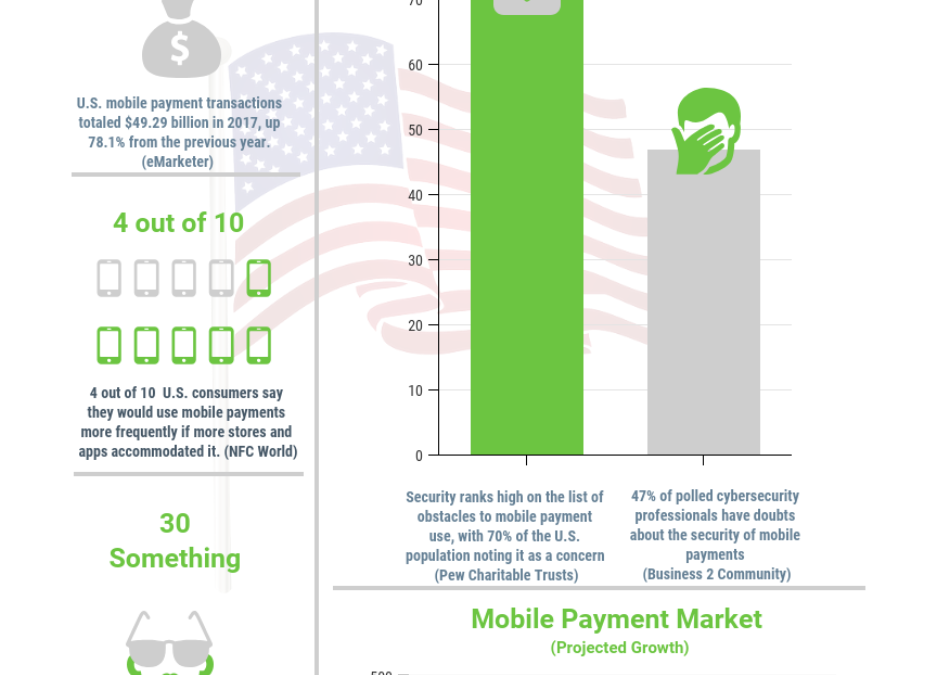

US Mobile Payments Stats

Where the US stands in relation to mobile payments.

Payments to hit 24 Trillion by 2027

Payments to hit 24 Trillion by 2027

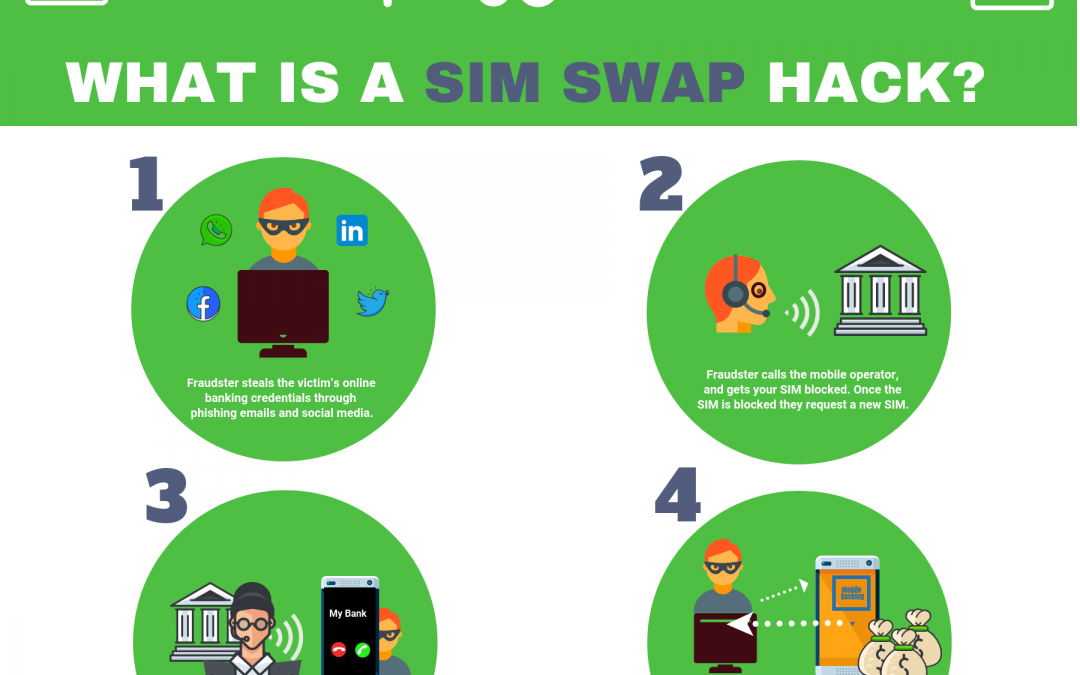

What is a SIM SWAP?

The new financial kid-n the block is SIM SWAP. What IS sim swap and how does it work?

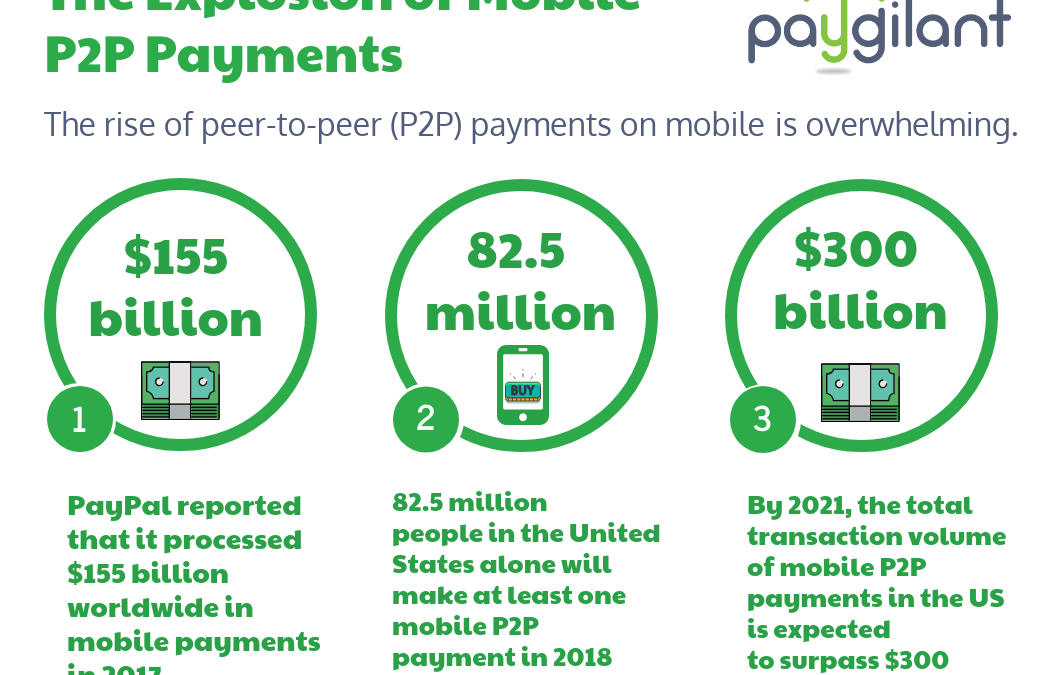

The Explosion of Mobile Payments

In just a few years, mobile P2P payments have exploded in popularity. Paygilant provides a real-time mobile fraud prevention solution for P2P, mobile wallets, financial institutions, and eCommerce.

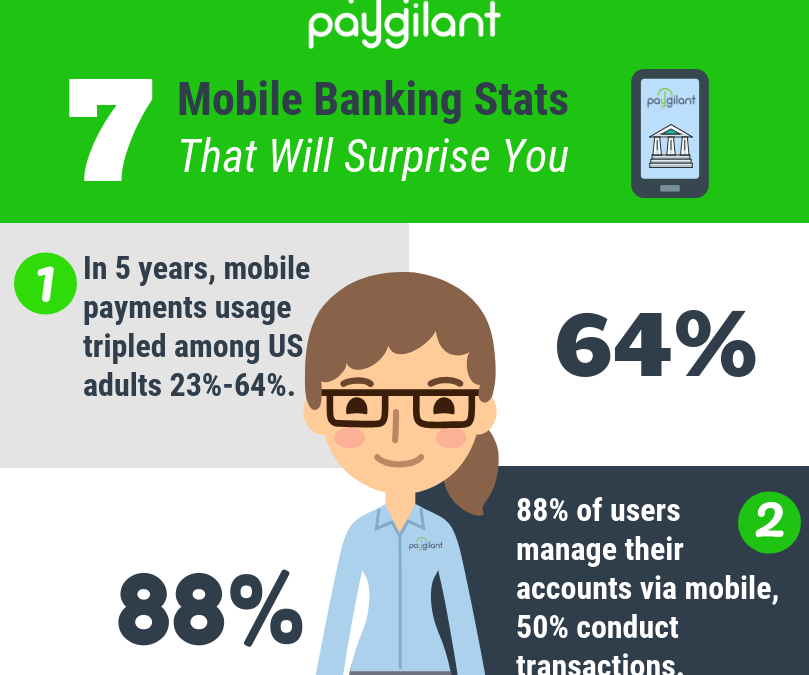

7 Mobile Banking Stats That Will Surprise You

Mobile Banking has become an integral part of the financial ecosystem. Almost all banks have one type of mobile payment app or another. But the are you aware of the widespread acceptability of mobile banking? Check out our 7 Mobile Banking Stats – That Will Surprise You infographic to learn the impact of mobile banking.