Datasheets

SIM SWAP Datasheet

SIM-SWAP fraud is on the rise and the costs involved are only scratching the surface. Paygilant stops SIM SWAP in its tracks.

Sign-up bonus fraud – Case study

Fraudsters are ripping off banks regularly using sign-up bonus fraud. The sign-up bonus fraud case study explains what it is and how financial institutions can mitigate it.

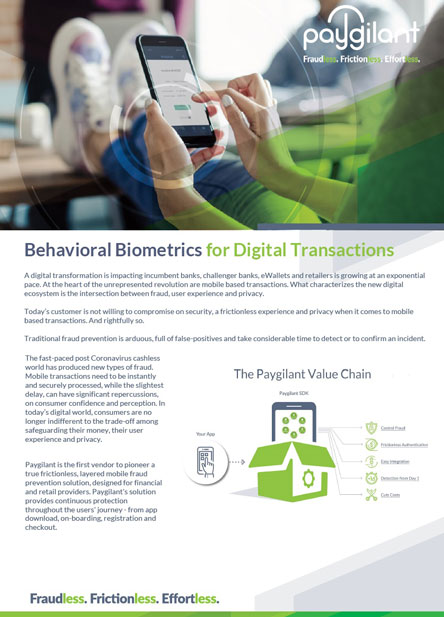

Behavioral Biometrics for Digital Transactions

Paygilant’s behavioral biometrics intelligence set, analyzes human-device interactions to prevent fraud. The Paygilant’s Bio Marker (intelligence set) learns the way an individual naturally interacts with the device and application, creating a unique biometric profile, which is used to distinguish between a legitimate customer from a fraudster.

Paygilant for eWallets

Paygilant has truly pioneered a true frictionless, layered mobile fraud prevention solution, designed for eWallet providers. Paygilant’s solution protects eWallet users throughout the users’ journey – from the app download, onboarding , registration and checkout.

Paygilant for Challenger Banks

Paygilant is the first vendor to pioneer a true frictionless, layered mobile fraud prevention solution, designed for challenger banks . Learn how Paygilant can help challenger banks prevent fraud and ensure frictionless authentication, while boosting profits.

Paygilant for Food Delivery

Paygilant’s solution provides food delivery merchants piece -of-mind by ensuring the authenticity of a transaction. Learn how Paygilant can help food delivery companies prevent fraud, reduce chargebacks and ensure quick and smooth transaction authentication.

Paygilant Overview Data Sheet

The Paygilant overview data sheet outlines what makes Paygilant solution unique and superior to the competition. The document exposes Paygilant secret sauce – its six intelligence sets that work in harmony to identify fraudulent behavior in milli-seconds.